How to Handle Payment Failures and Retries?

- Subhadip Samanta

- Mar 28, 2025

- 4 min read

Payment failures happen due to multiple reasons. Whether it’s due to a network glitch, an expired card, or a temporary bank issue, these failures can impact revenue and customer experience.

A robust retry mechanism is needed to ensure smooth transactions while preventing duplicate charges.

A well-thought-out retry strategy can mean the difference between recovering failed payments and frustrating users.

In this article, I’ll break down:

How to track payment statuses

When to retry vs. when to stop

The power of Retry Queues & Dead Letter Queues

Preventing duplicate charges with Exactly-Once Delivery

Let’s dive in.

How to Track Payment Statuses?

Before implementing retries, it is needed to track and categorize payment statuses effectively.

Most payment gateways provide the following statuses:

Success: The payment has been processed successfully. No further action needed.

Pending: The payment is under review or awaiting confirmation (e.g., 3D Secure authentication).

Failed: The payment attempt was unsuccessful due to reasons like insufficient funds, expired card, or network issues.

Declined: The issuing bank has explicitly rejected the payment.

Chargeback: The customer disputed the transaction, and funds were withdrawn.

When to Retry vs. When to Stop?

A smart retry strategy depends on the failure reason:

When to Retry:

✅ Temporary network issues (e.g., timeout, service unavailability) → Retry after a short delay

✅ Insufficient funds → Retry after 24–48 hours when the customer might have added funds

✅ Bank processing delays → Retry after a short interval (e.g., 10–15 minutes).

When to Stop:

❌ Card expired → Prompt user for a new payment method instead of retrying

❌ Fraud suspicion/Declined by issuer → Do not retry. Ask the customer to contact their bank

❌ Chargeback initiated → Halt retries and follow dispute resolution.

The Power of Retry Queues & Dead Letter Queues

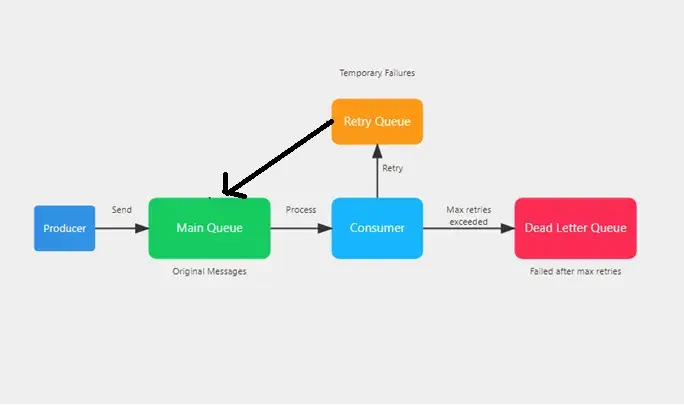

To manage retries effectively, Retry Queues and Dead Letter Queues (DLQs) would be used.

Retry Queues: Implement an exponential backoff strategy (e.g., 1 min → 5 min → 30 min → 24 hours). This prevents overwhelming payment processors.

Dead Letter Queues (DLQ): If a payment fails after multiple retries, move it to a DLQ for manual intervention or customer notification.

The following diagram explains how retry queues and dead letter queues can simplify the retry process during payment failure

Exponential Backoff Strategy

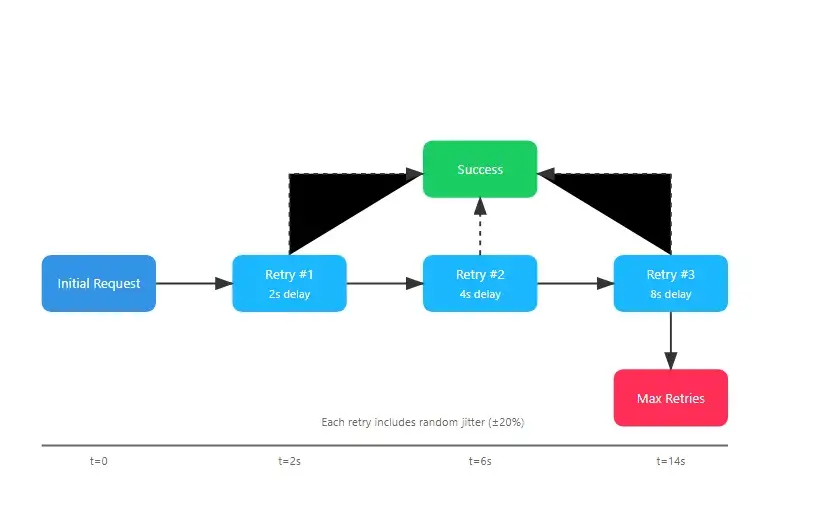

An exponential backoff strategy needs to be implemented to avoid overwhelming an already overwhelmed system.

Here is an example of exponential back-off strategy:

First retry: After 1 minute

Second retry: After 5 minutes

Third retry: After 30 minutes

Final retry: After 24 hours

The delays are increasing after each retry this to give the system more time to recover.

If we keep retrying in 1 minute and sending thousands of request then we will put more pressure on a system which is already breaking with load.

Think of it has a DDOS attack which can eventually bring down the whole application.

By the way retry interval totally depends upon business requirements

Preventing Duplicate Charges with Exactly-Once Delivery

One of the biggest risks in payment retries is charging a customer multiple times for the same transaction.

To prevent this:

Use idempotency keys: Store a unique key for each transaction to ensure retries don’t create duplicate charges.

Implement transactional locks: Ensure only one retry attempt is processed at a time.

Design for Exactly-Once Delivery: Ensure that payment processors only execute the charge once, even if multiple requests are sent.

By using these tricks the risk of charging a customer multiple times can be minimised for the same transaction.

What Causes Payment Failure? Impact and Solution

Payment Failure is real and it happens more often then can be thought of. I have seen Payment failure both as a user and as a developer in most cases the payment failure is caused in trading system if

Their payment retry system couldn’t handle the surge in trading volume

Their circuit breaker logic incorrectly triggered due to too many failed payments

Insufficient retry queues caused payment transaction backlogs

Lack of proper monitoring failed to alert teams early

And, the impact of payment failure is immense. Imaging if this payment failure occurring in trading day then :

Users will not be able to trade during major market movements

losses in millions for customers

Severe reputation damage

Now, the big question comes how to avoid this?

Here are following ways through which payment failure can be avoided:

Implement robust payment retry mechanisms

Implement proper circuit breaker thresholds

Design scalable queue systems

Have real-time monitoring and alerts

Test systems under extreme load conditions

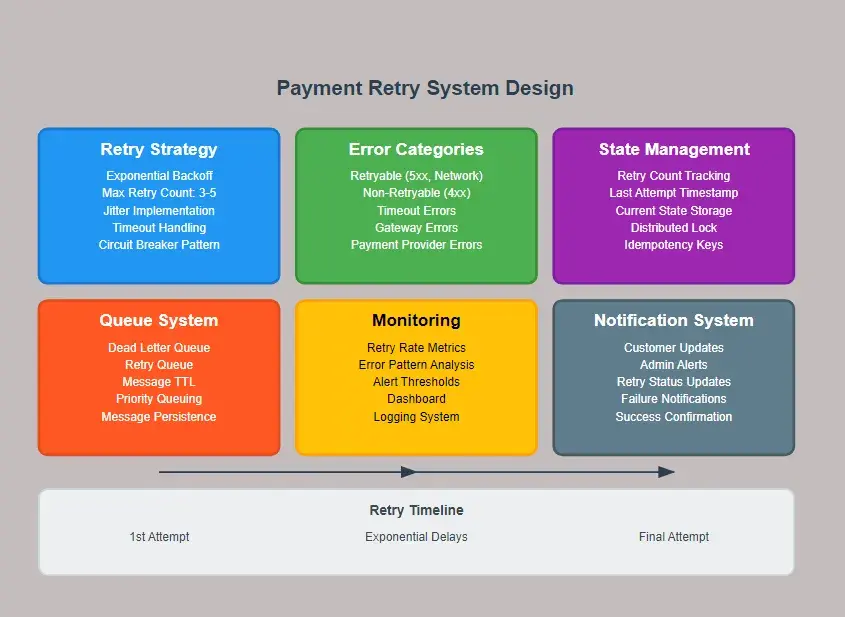

Payment Retry System Design

And here is a nice summary of what can be done on Payment retries, this image condense a comprehensive information regarding payment retires.

Conclusion

That’s all about how to handle payment failures and implement retries in an Application or System.

A well-managed retry system ensures:

Reduced revenue loss due to transient failures

Improved customer experience with seamless transactions

Prevention of duplicate charges and fraud risks

By tracking payment statuses, implementing smart retry strategies, leveraging retry queues, and ensuring exactly-once delivery, a resilient and reliable payment system can be built.

Comments